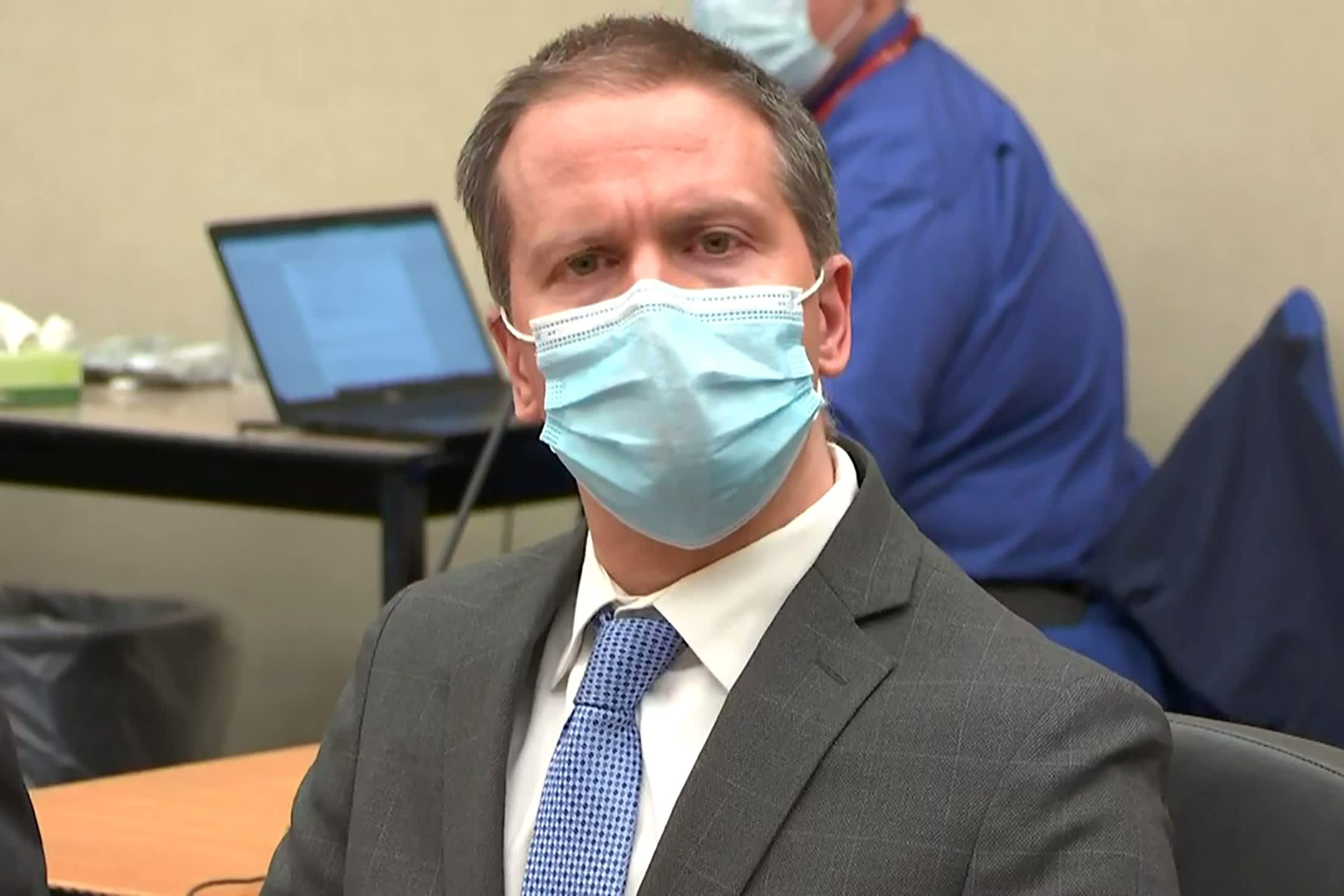

A man on the phone walks past the headquarters of the Central Bank of Russia in downtown Moscow on March 19, 2021 while the Russian flag flies.

KIRILL Kudryavtsev | AFP | Getty Images

As the economy moves online, digital currencies will be the future of financial systems, according to Russia’s central bank governor Elvira Nabiullina.

There is a need for fast, cheap payment systems, and central bank digital currencies can fill that void, she told CNBC’s Hadley Gamble in an exclusive interview.

“I think it’s the future of our financial system because it correlates with this evolution of the digital economy,” she said.

Moscow published a consultation paper on a digital ruble in October and aims to have a prototype ready by the end of 2021. Pilots and tests could begin next year, Nabiullina said.

“We’re going to take it step by step because it is [a] very difficult, technological, legal … project, “she said.

Central bank digital currencies are not the same as cryptocurrencies like Bitcoin. They will be issued and controlled by authorities, and the value of one digital ruble will be equivalent to one cash ruble, the Bank of Russia said last year.

Until last year, cryptocurrencies were illegal in Russia and still cannot be used for payments.

Read more about cryptocurrencies from CNBC Pro

Many central banks around the world are developing sovereign digital currencies, which proponents say could promote financial inclusion and facilitate cross-border transactions.

But Nabiullina predicts that there will be challenges in finding “common solutions” between systems that have been independently developed by different countries.

“If every bank can do it [its] own system, technological systems with local standards, it will be very difficult to make connections between these systems in order to facilitate all cross-border payments, “she said.

Against US sanctions

Nabiullina also commented on US sanctions, which she described as an “ongoing risk” for Russia.

Washington has imposed sanctions on Russia over the years for a variety of reasons, from alleged poisoning against opposition politicians to alleged election meddling and cyberattacks.

“That is why our monetary policy, as well as fiscal policy and overall macroeconomic policy, are quite conservative,” she said.

Moscow’s reserves are “quite large to withstand any financial or geopolitical scenario” and are likely to be more diverse than other countries’ reserves, she said.

“De-Dollarization” is part of a comprehensive policy for dealing with foreign currency risks, said Nabiullina.

However, experts say Russia is gradually moving away from using the US dollar to protect itself from the effects of sanctions that all companies using the currency can target.

In 2019, Anne Korin, co-director of the Institute for the Analysis of Global Security, told CNBC that there was a “growing club” of “very powerful” players who wanted to undermine the importance of the greenback.

China, Russia and the European Union have a strong “motivation to de-dollarize,” she said at the time.

Nabiullina said she sees a trend towards countries with more diversified international reserves, but that is likely to slowly shift.

“It will happen, but not very quickly,” she said.